0

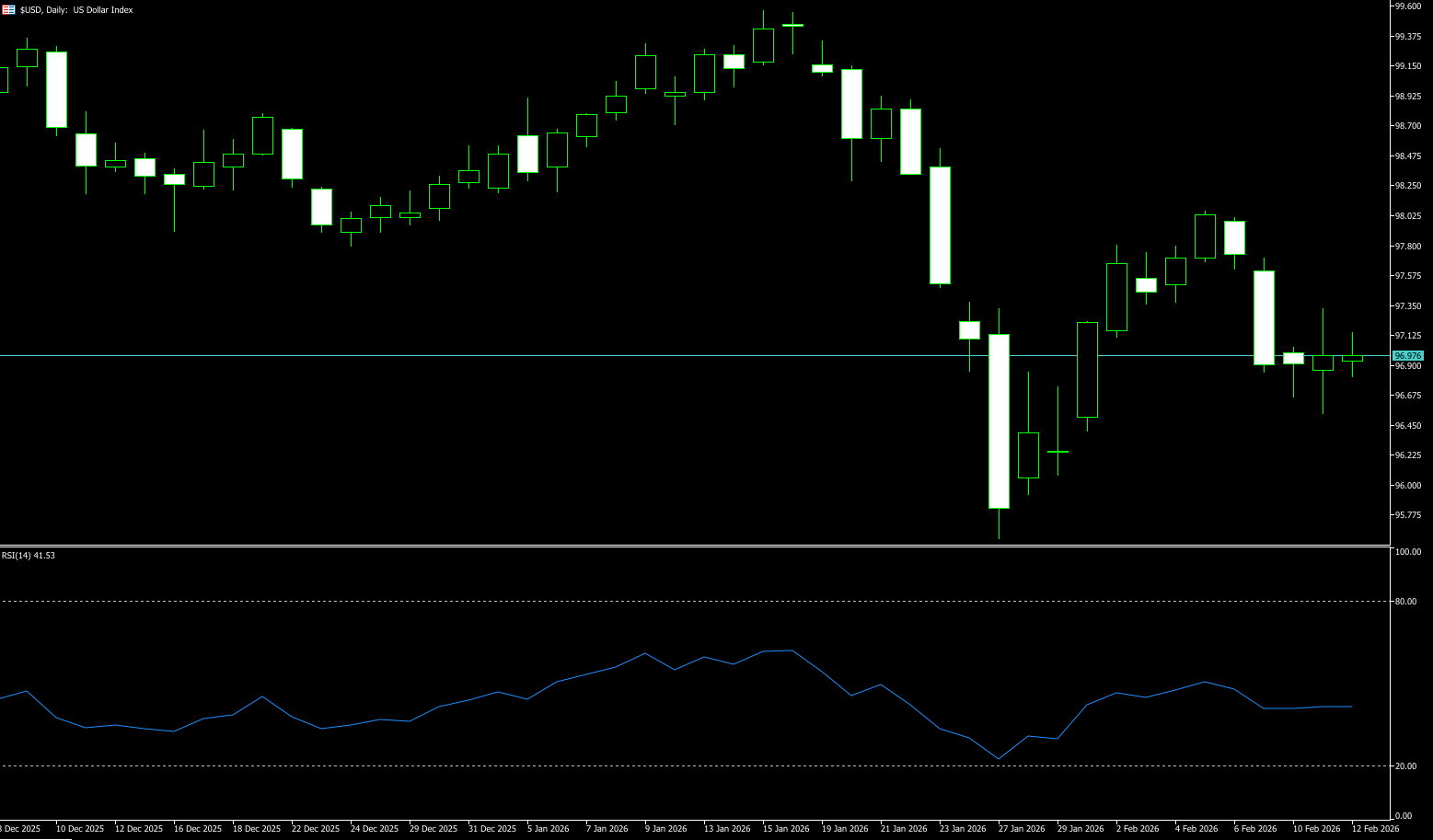

US Dollar Index

The US dollar index held steady slightly below 97 on Thursday, after more volatile trading in the previous session, supported by stronger-than-expected US labor market data, which reduced the likelihood of a near-term Federal Reserve rate cut. Data released Wednesday showed that non-farm payrolls increased by 130,000 in January, the largest increase in over a year, while the unemployment rate unexpectedly fell to 4.3%, indicating that the labor market is stabilizing in early 2026. Meanwhile, initial jobless claims were higher than expected. Market focus now shifts to Friday's January Consumer Price Index report for further insights into inflation dynamics. The market currently expects the Federal Reserve to keep interest rates unchanged in March and anticipates two rate cuts this year, in June and September. The dollar also received additional support from a weaker yen, which had risen sharply in the previous three trading days due to verbal intervention by Japanese authorities.

From the daily chart and moving average system, the main trend of the US dollar index remains downward. If the price breaks through 97.30 (the 9-day moving average), the main trend will turn upward; if it falls below 96.49 (this week's low), the downward trend will be reconfirmed. The short-term fluctuation range is 96.49–97.76 (this week's high). The US dollar index found support at 96.49, within the 96.49–96.00 retracement range. The subsequent rebound may provide sufficient upward momentum for the index to challenge the medium-term retracement range of 97.30–97.76. If it breaks through this medium-term range, the US dollar index is expected to test the 98.00 (psychological level) and the 50-day moving average at 98.12. The support range of 96.49–96.00 is crucial to the short-term trend structure and requires close attention.

Today, consider shorting the US Dollar Index around 97.00; Stop loss: 97.15; Target: 96.65; 96.55

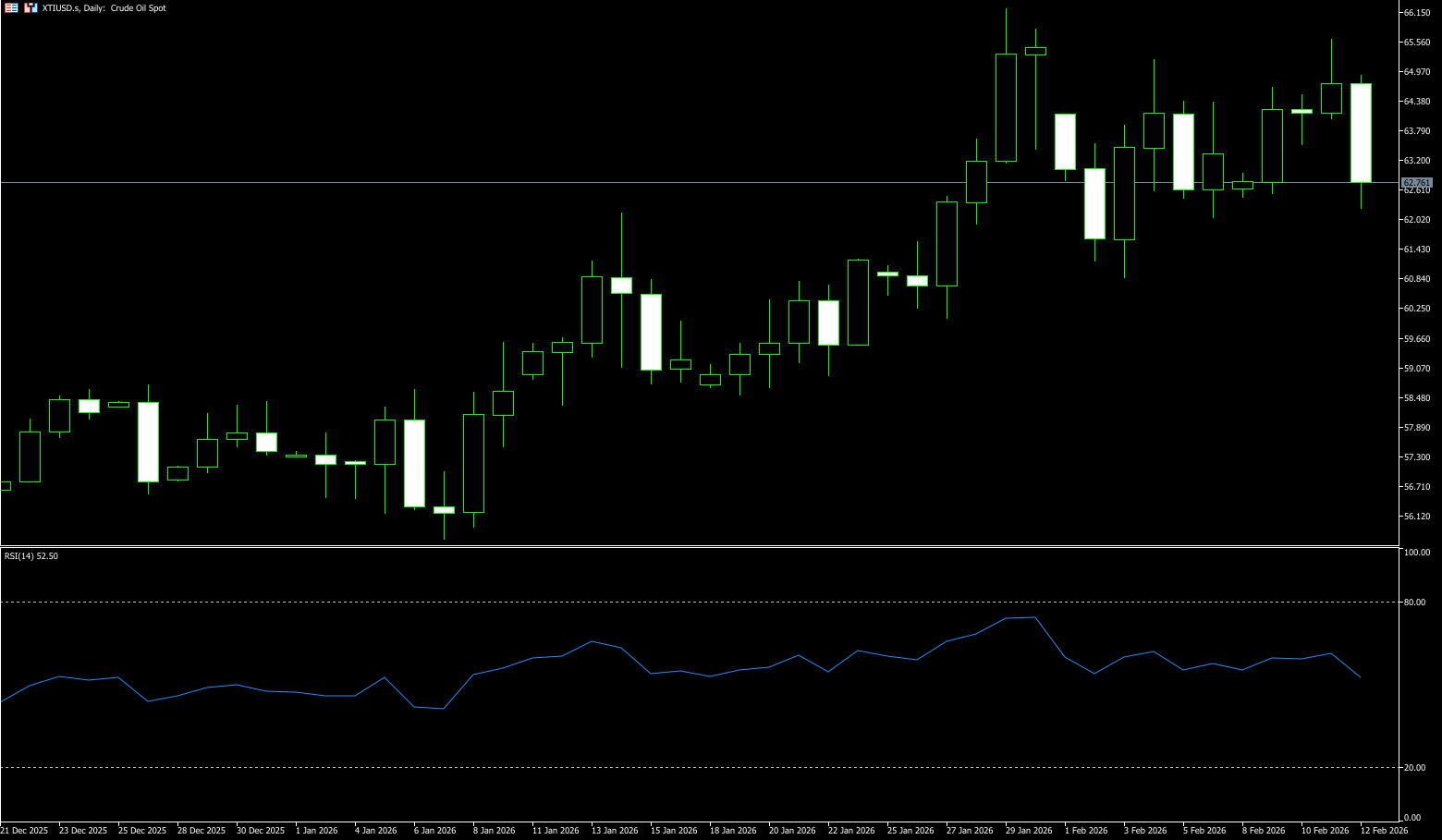

WTI Crude Oil

WTI crude oil fell below $62.80 per barrel on Thursday, retreating after rising 1% in the previous session, pressured by persistent oversupply despite ongoing Iranian risks. The market remains focused on tensions surrounding Iran, as the US has indicated a preference for a nuclear deal but keeps military options open and has deployed naval forces in the region, continuing concerns about potential supply disruptions. Nevertheless, ample supply is limiting prices. The International Energy Agency stated that global oil inventories grew at their fastest pace since 2020 last year and projects a significant oversupply by 2026 as supply exceeds demand. The increase in inventories reinforces market expectations of an oversupply. Supply from Venezuela is also returning as China purchases goods previously linked to the US.

From a technical perspective, considering multiple technical indicators including oscillators, trend lines, and moving averages, the main trend for WTI crude oil remains upward. Although it has slowed somewhat recently, there are no obvious signs of weakness. Specifically, if oil prices can successfully break through the key resistance level of $65.64 (Wednesday's high), it will further activate bullish sentiment and strengthen the upward momentum. The next important targets will be $66.00 (psychological level) and $66.48 (previous high). If this high is successfully broken, oil prices may challenge the $70.00 mark. Regarding support levels, the current trendline support has moved down to $62.25 (Thursday's low), followed by the low of the $61.10 (30-day moving average) area, where oil price momentum will likely shift to the downside.

Today, consider going long on crude oil around 62.65; Stop loss: 62.50, Target: 64.00; 64.50

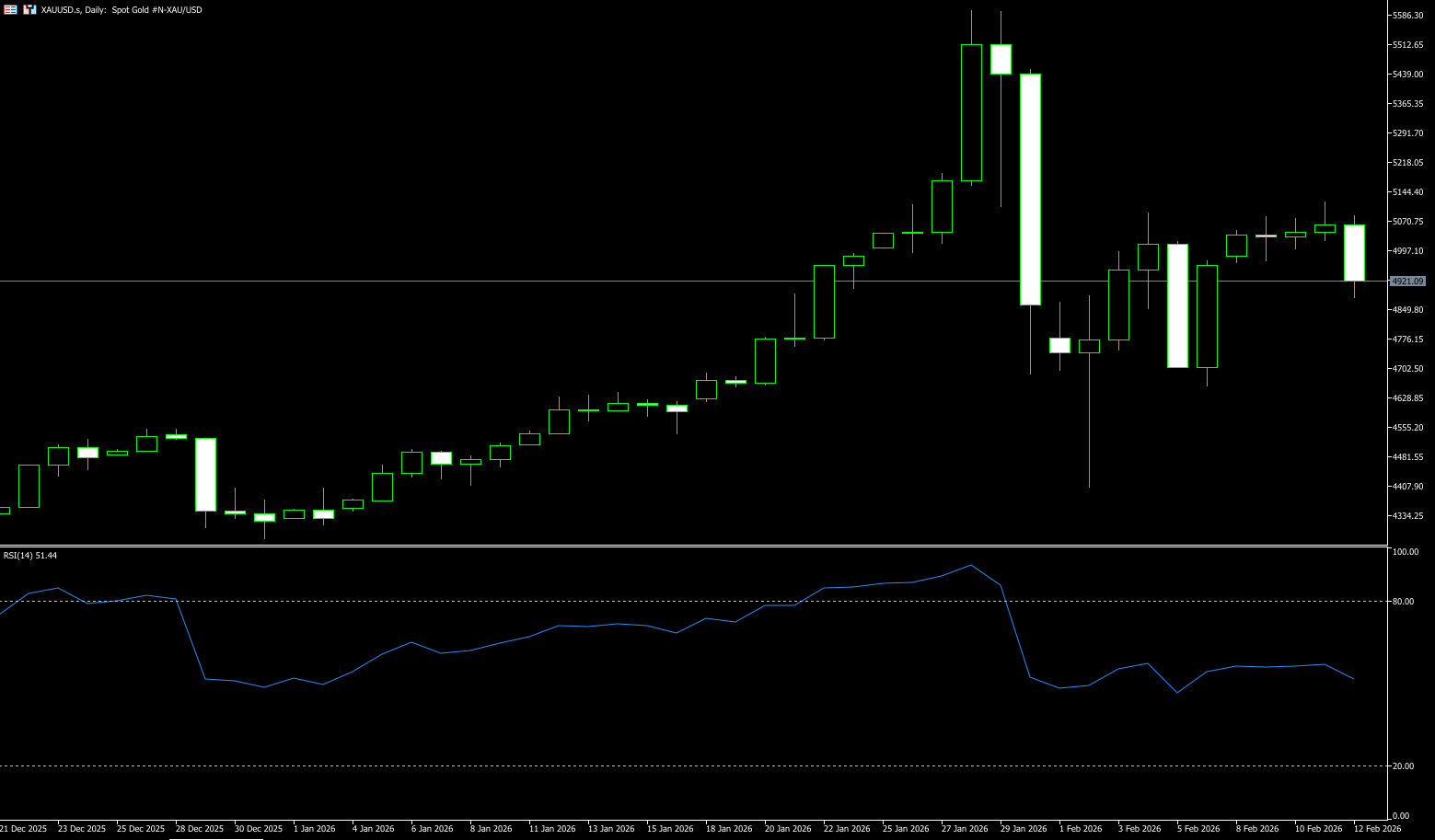

Spot Gold

Gold fell more than 3% on Thursday afternoon, dropping below $4,920 per ounce, extending its sharp correction as cross-asset liquidation forced investors to sell precious metals to meet margin requirements and cover losses elsewhere. While the US 10-year Treasury yield fell to its lowest level in two months, this decline was not due to expectations of higher interest rates, but rather to short-term liquidity needs and position liquidation after a sustained rally. Silver and copper also fell sharply, highlighting widespread selling pressure in the metals market. Although the market expects upcoming consumer price index data to show slowing inflation and still anticipates two Fed rate cuts later this year, recent fund flows have been primarily driven by deleveraging rather than policy repricing. Despite the setback, slowing yields, continued central bank purchases, and ongoing geopolitical uncertainty continue to provide fundamental support for gold once liquidation pressures stabilize.

From a technical perspective, the 4-hour chart for gold prices shows a downside bias. The 20-period simple moving average (SMMA), after a steady rise, is beginning to flatten and remains above the slower 100-period and 200-period SMMAs. The price is below the 20 and 100-period SMMAs, providing resistance in the $5,012.10 - $5,049.90 range, while the $4,800 (psychological level) and the 200-period SMMA at $4,769.00 provide dynamic support. Meanwhile, technical indicators have sharply turned bearish, moving almost vertically into negative territory, reflecting increasing selling pressure. On the daily chart, gold prices briefly broke above the bullish 20-day SMMA before recovering above it, but remain close, currently at the SMMA at $4,952.00. Longer-term moving averages remain well below shorter-term moving averages and have not yet shown correlation, but still maintain an upward trend. Finally, the momentum indicator is crossing its midline, and the Relative Strength Index (RSI) has also turned downwards, currently at 53, both suggesting potential lower lows in the future.

Consider going long on gold today around 4,910; Stop loss: 4,900; Target: 4,970; 5,000

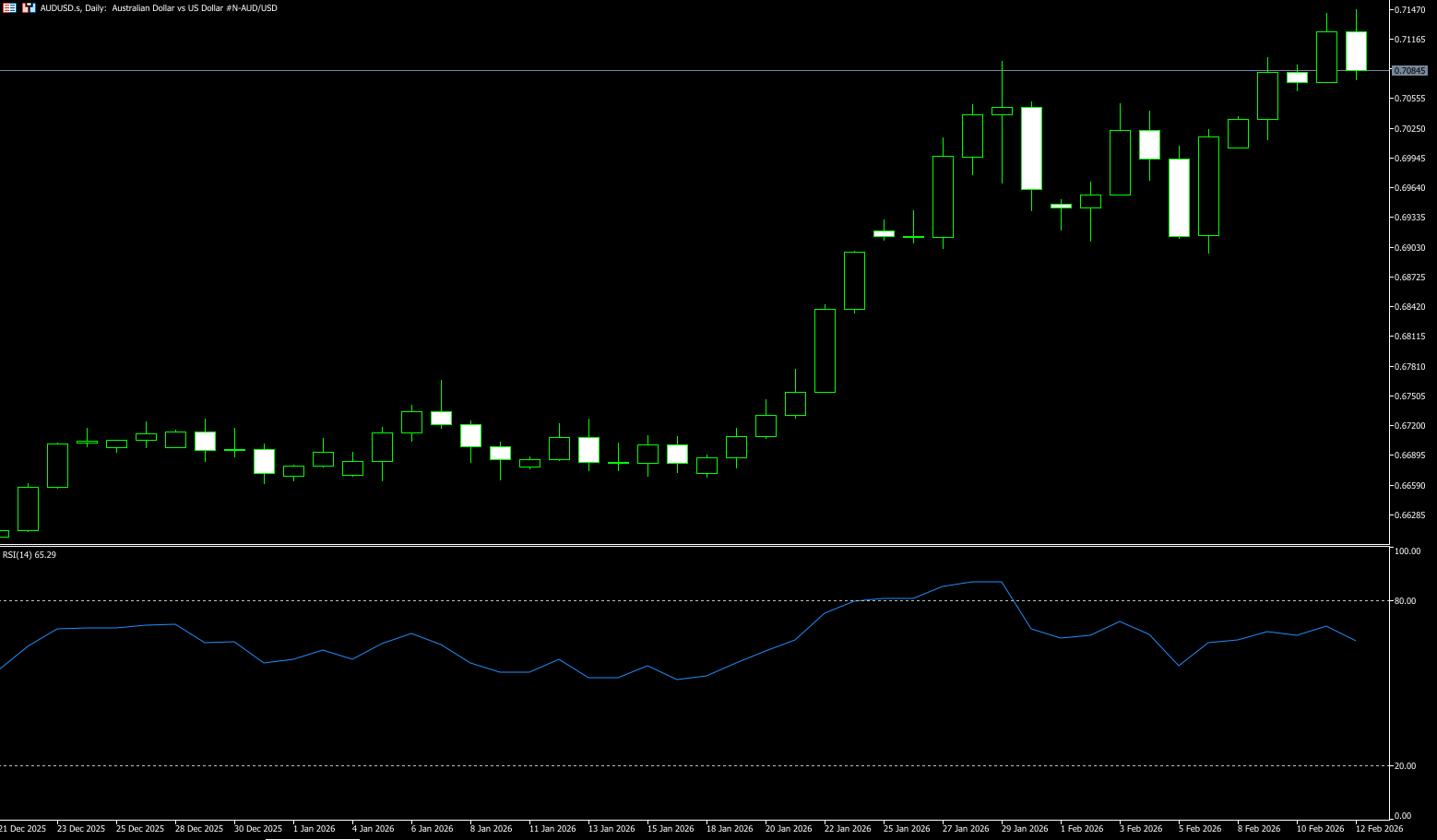

AUD/USD

The Australian dollar rose above US$0.71 on Thursday, extending its rebound to a three-and-a-half-year high, after the Reserve Bank of Australia signaled a further hawkish policy stance. RBA Governor Michelle Block stated that the board is prepared to raise interest rates further if inflation persists and considers any "three-ahead" inflation unacceptable. Her comments reinforced Deputy Governor Hauser's warnings, who noted the previous day that inflation remained too high and continued to pose a significant challenge to the board in setting interest rates. A consumer survey released shortly after her speech showed that inflation expectations jumped to 5% in February, the highest level since mid-2025, further reinforcing the hawkish tone. Economists now widely expect a possible interest rate hike in May as the Reserve Bank of Australia weighs first-quarter inflation data against upcoming employment and GDP reports. Assistant Governor Sarah Hunt is also scheduled to speak in Perth later on Thursday, offering further insights.

On the daily chart, the AUD/USD pair traded above a three-year high of 0.7100, pushing the price to an intraday high of 0.7140. The pair is firmly above the 9-day simple moving average at 0.7040, confirming a strong bullish trend structure from the December low of 0.6466, forming higher highs and higher lows. The rally since the end of January has been quite aggressive, with the pair rising over 400 pips from its consolidation range near 0.6700. The MACD histogram remains positive, showing the MACD line above the signal line. The 14-day Relative Strength Index (RSI) is at 72.35, reinforcing the modest upward bias. Immediate resistance is located at 0.7157, near the 2023 high, with the next target at the psychological level of 0.7200 and a possible opening at 0.7250. Support is at the 9-day simple moving average of 0.7040, followed by the psychological level of 0.7000.

Consider going long on the Australian dollar today near 0.7080; Stop loss: 0.7070; Target: 0.7140; 0.7150

GBP/USD

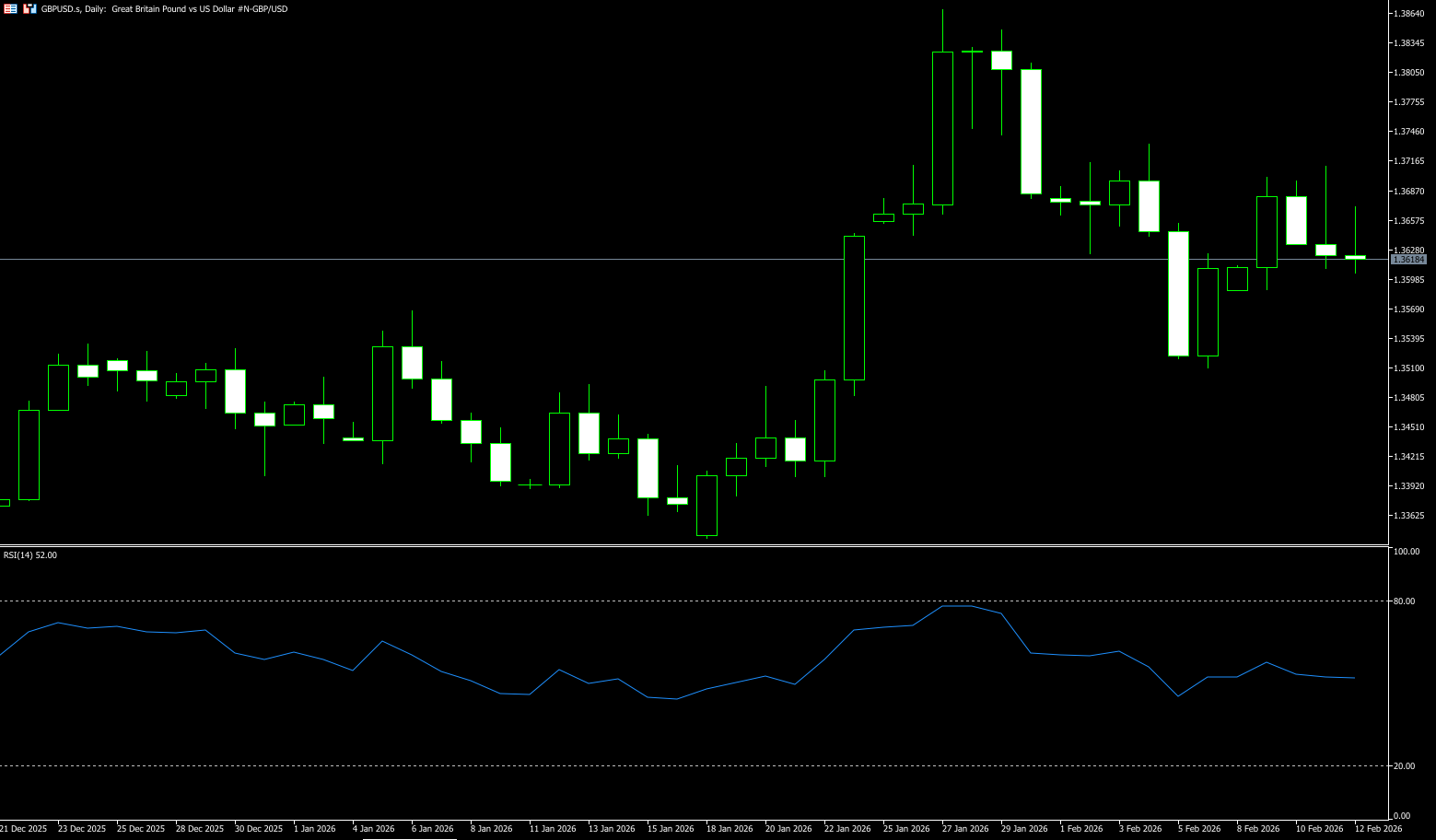

The pound retreated from a four-year high midweek, influenced by the Bank of England's dovish stance and UK political uncertainty, despite a weaker US dollar due to a weak labor market correction. The Bank of England kept interest rates unchanged at its February meeting, but the 5-4 vote in the Monetary Policy Committee (MPC) surprised the market, with four members supporting an immediate 25 basis point cut, a more dovish outcome than expected. Bank of England Governor Andrew Bailey indicated that inflation is expected to reach the 2% target sooner than anticipated, and the market now anticipates an additional 50 basis points of easing in 2026. On Friday, Bank of England MPC member Pill will speak, while the delayed US January Consumer Price Index (CPI) will be in focus, expected to be 2.5% year-on-year and 0.3% month-on-month core. Softer CPI data could reignite dollar selling, but despite the Bank of England's dovish stance, it will still support GBP/USD.

On the daily chart, GBP/USD is trading at 1.3620, having retreated from the late January high of 1.3869, a level not seen since early 2022. The price remains above the 34-day (1.3552) and 50-day (1.3505) simple moving averages, maintaining the broader bullish trend structure since the November low of 1.3010, characterized by higher highs and higher lows. The pullback from 1.3869 was orderly, with the pair finding support near 1.3600 in multiple trades. Near-term support lies between the 34-day (1.3552) and 50-day (1.3505) simple moving averages, an area coinciding with the recent consolidation lows. A hold of this area would maintain the bullish structure for a retest of the 1.3686 (50% Fibonacci retracement level measured from the high of 1.3862 to the low of 1.3510) and 1.3733 (February 4th high) areas. A break above these resistance areas would pave the way for 1.3800.

Consider going long on GBP near 1.3610 today; Stop Loss: 1.3600, Target: 1.3660; 1.3650

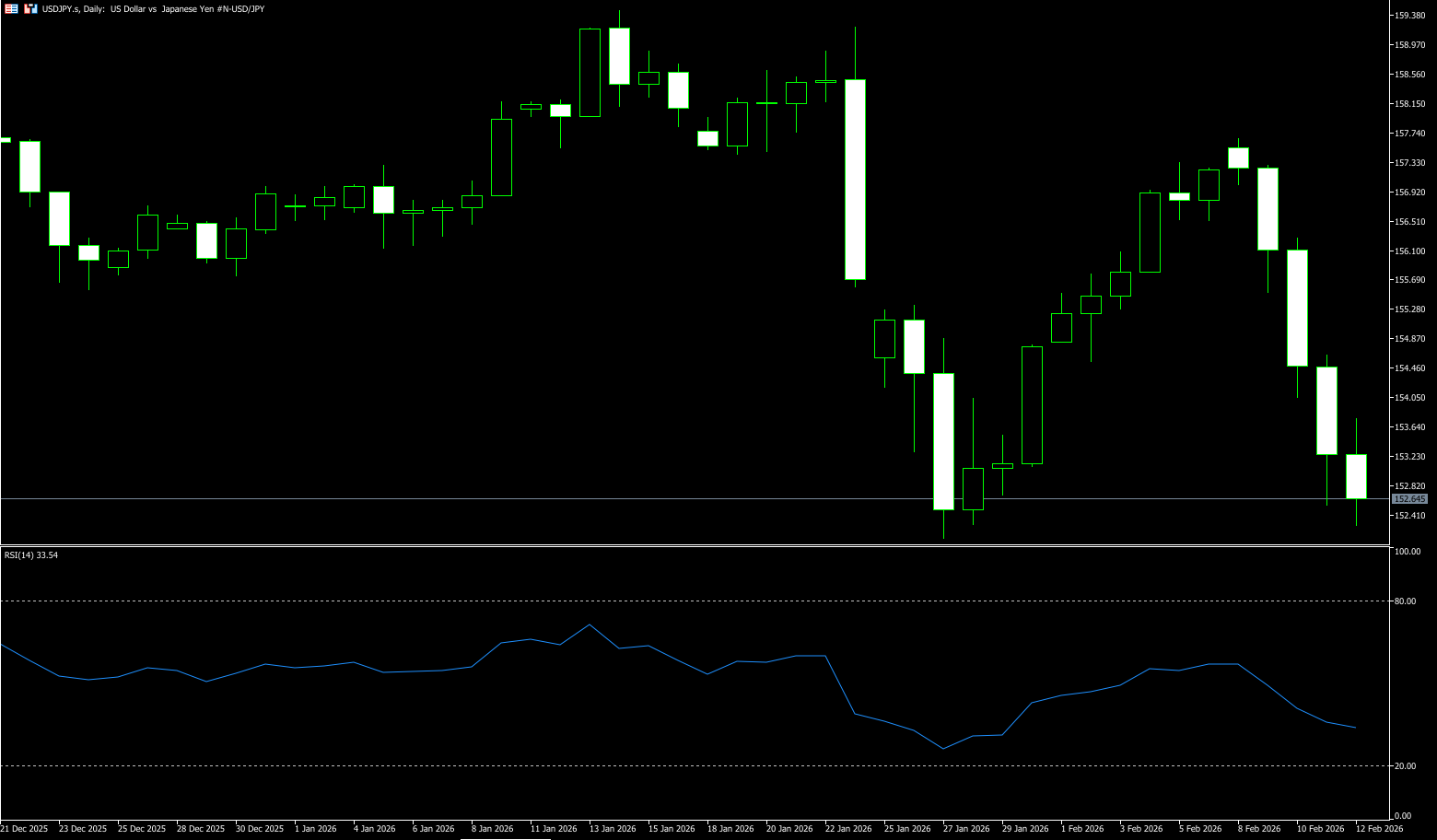

USD/JPY

USD/JPY attracted some selling pressure on Thursday, falling to around 153.00. The Bank of Japan strengthened against the dollar following Prime Minister Sanae Takashi's landslide election victory. Market focus will now shift to the US Consumer Price Index (CPI) inflation report later on Friday. Takashi may place greater emphasis on fiscal responsibility, and market-friendly policies may be on the horizon. Traders flocked to Japanese stocks, anticipating stimulus measures flowing to consumers and Japanese companies, boosting demand for the yen and putting downward pressure on the pair. Such a landslide victory gives the Takashi administration better control over the so-called "Takashi trade" regarding bearish sentiment in Japanese government bonds and the yen. However, optimistic US jobs data could help limit dollar losses in the short term. Strong January jobs data reduced the likelihood of another Fed rate cut in the middle of the year. The market now prices the probability of the Fed keeping rates unchanged at its next meeting at 94%, up from 80% the previous day.

From a technical perspective, the short-term outlook for USD/JPY has turned bearish after the pair broke below its key daily moving average. Momentum indicators also remain weak. The Relative Strength Index (RSI) is hovering around 30-35, in bearish territory, indicating room for further declines, while the currency pair is not yet deeply oversold. On the downside, a clear break below 152.00 would expose the 200-day simple moving average near 150.55. A decisive break below the 200-day moving average would strengthen the bearish bias and open the door to a deeper corrective pullback towards the psychological level of 150. Measuring from the low of 152.23 to the high of 159.05, the 78.6% Fibonacci retracement level is at 153.69, and the 61.8% retracement level is at 154.84, representing a key short-term resistance area to watch during any rally. The 100-day simple moving average near 154.66 also acts as an important intermediate resistance level within this area.

Today, consider shorting the US dollar near 153.00; Stop loss: 153.20; Target: 152.30; 152.10

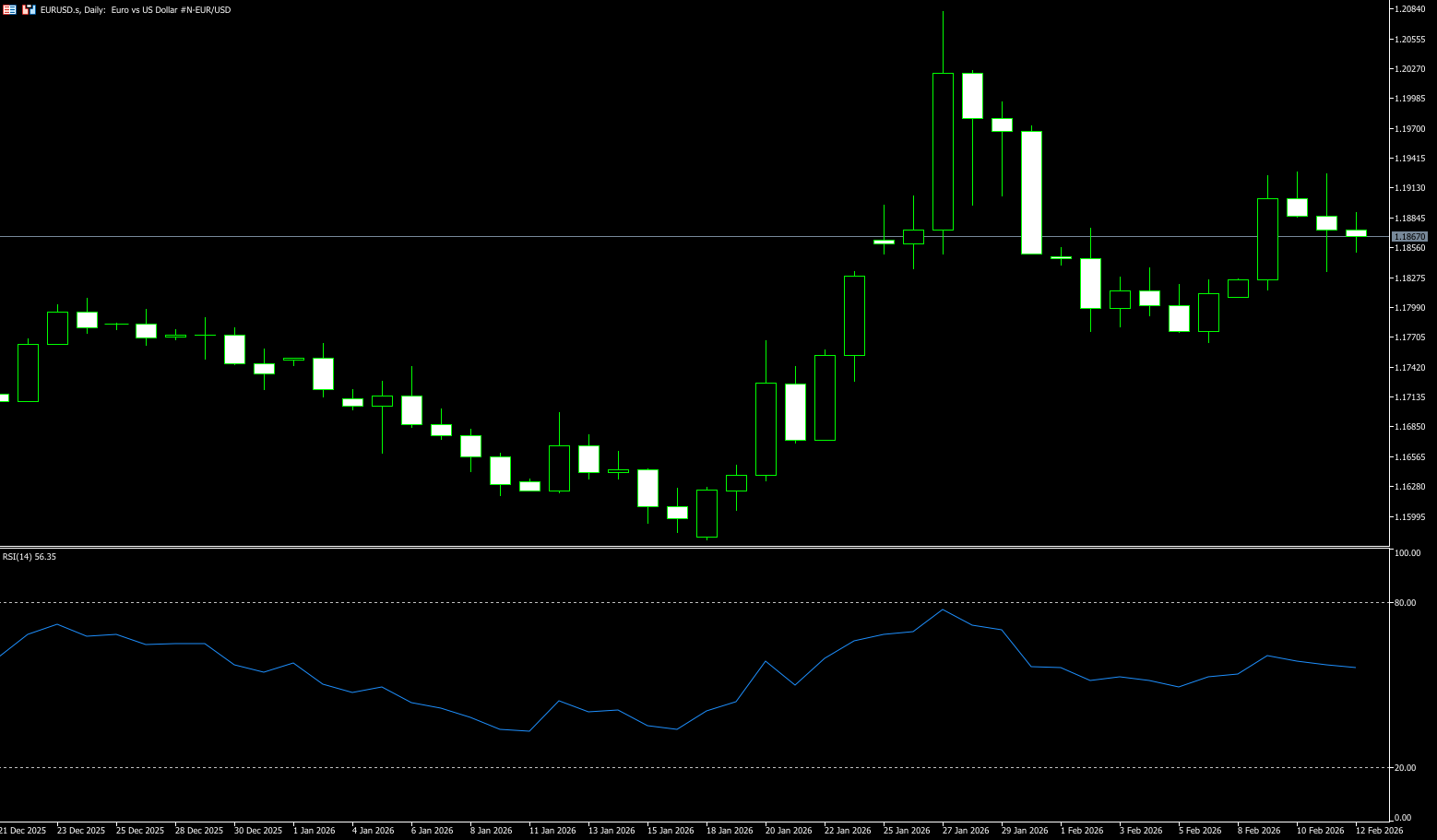

EUR/USD

The EUR/USD pair struggled to capitalize on the rebound from the 1.1835-1.1830 area during Thursday's Asian session, consolidating within a narrow range. Currently, spot prices are trading near 1.1875, little changed on the day, and remain within reach of Tuesday's more than one-week high, with mixed signals. Following Wednesday's strong US non-farm payrolls report, investors reduced their expectations for more aggressive policy easing from the Federal Reserve. Furthermore, hawkish comments from Kansas City Federal Reserve President Jeffrey Schmid, suggesting further rate cuts could prolong high inflation, helped stabilize the dollar near two-week lows. This is seen as a key factor putting downward pressure on the EUR/USD pair. On the other hand, increased market acceptance of the European Central Bank likely keeping interest rates unchanged for the remainder of the year provided support for the EUR/USD pair.

The daily chart suggests that EUR/USD may attempt to reach the 1.2000 level again. The next major obstacle is the 2026 high of 1.2082 (January 28th). A decisive break above this level would refocus attention on the May 2021 high of 1.2266 (May 25th). On the other hand, the first real support level is at 1.1775 (February 2nd). A break below this level would test the 50-day and 100-day simple moving averages at 1.1755 and 1.1683 respectively. The 200-day simple moving average at 1.1625 is more significant. If selling pressure continues to rise, the November 2025 low of 1.1468 (November 5th) could reappear. From a momentum perspective, the background still looks favorable. The Relative Strength Index (RSI) is around 57, indicating that buyers remain in control. The Average Directional Index (ADX) is slightly above 31, suggesting that the trend still has some strength.

Consider going long on the Euro today around 1.1858; Stop loss: 1.1845; Targets: 1.1920, 1.1910

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Lebih Liputan

Pendedahan Risiko:Instrumen derivatif diniagakan di luar bursa dengan margin, yang bermakna ia membawa tahap risiko yang tinggi dan terdapat kemungkinan anda boleh kehilangan seluruh pelaburan anda. Produk-produk ini tidak sesuai untuk semua pelabur. Pastikan anda memahami sepenuhnya risiko dan pertimbangkan dengan teliti keadaan kewangan dan pengalaman dagangan anda sebelum berdagang. Cari nasihat kewangan bebas jika perlu sebelum membuka akaun dengan BCR.

BCR Co Pty Ltd (No. Syarikat 1975046) ialah syarikat yang diperbadankan di bawah undang-undang British Virgin Islands, dengan pejabat berdaftar di Trident Chambers, Wickham’s Cay 1, Road Town, Tortola, British Virgin Islands, dan dilesenkan serta dikawal selia oleh Suruhanjaya Perkhidmatan Kewangan British Virgin Islands di bawah Lesen No. SIBA/L/19/1122.

Open Bridge Limited (No. Syarikat 16701394) ialah syarikat yang diperbadankan di bawah Akta Syarikat 2006 dan berdaftar di England dan Wales, dengan alamat berdaftar di Kemp House, 160 City Road, London, City Road, London, England, EC1V 2NX. Entiti ini bertindak semata-mata sebagai pemproses pembayaran dan tidak menyediakan sebarang perkhidmatan perdagangan atau pelaburan.