0

U.S. Dollar Index (DXY)

The U.S. Dollar Index edged higher on Tuesday, climbing back above the 99.00 level, as markets broadly expect the Federal Reserve to deliver a so-called “hawkish rate cut” later this week. This means the Fed may cut rates while simultaneously signaling a cautious approach toward further easing, which has provided support for the dollar. At the same time, the Japanese yen weakened sharply across the board following a powerful earthquake in Japan.

Markets have largely priced in a Fed rate cut this week, but investors believe the policy statement and Chair Jerome Powell’s remarks could imply a higher threshold for additional cuts ahead. This expectation has helped underpin the dollar. After the strong earthquake struck northeastern Japan on Monday, the yen immediately came under pressure. Speculation has also emerged that the Bank of Japan may delay its planned rate hike scheduled for next week, depending on the extent of the damage. USD/JPY rose 0.3% to 155.97.

Several other central banks, including those of Australia, Canada, Switzerland, and Brazil, will also hold meetings this week, but all are expected to keep rates unchanged. In Australia’s case, strong economic data has already led markets to anticipate a possible rate hike next year.

Currently, the Dollar Index is locked in a tug-of-war between bullish and bearish forces. On one hand, the U.S. economy remains resilient, and expectations of fiscal expansion provide a degree of support. On the other hand, a gradually more dovish monetary policy outlook and rising political uncertainty are limiting upside potential. The issue of the next Fed chair has become a key variable in market pricing, at times exerting even greater influence than some macroeconomic data.

Unless there is a significant upside surprise in U.S. non-farm payrolls or inflation, or Chair Powell unexpectedly adopts a hawkish tone, the Dollar Index is likely to remain in a range-bound but slightly weaker pattern. The next decisive signal may not come from an economic report, but from an off-the-cuff remark.

Key support levels this week lie at 98.77 (five-week low) and 98.62 (100-day SMA), while resistance is seen at 99.41 (200-day SMA) and 99.71 (November 27 high).

WTI Crude Oil (Spot)

U.S. crude oil is trading near $58.30 per barrel, with prices down more than 2% so far this week. The decline has been driven mainly by the resumption of production at a major Iraqi oil field, along with persistent market focus on Ukraine peace negotiations.

The restart of key Iraqi production, combined with geopolitical risks stemming from the Ukraine situation and recent attacks on energy infrastructure, triggered the sharpest weekly drop in global oil prices in nearly three weeks earlier this week. Meanwhile, markets are also focused on expectations for a 25-basis-point Fed rate cut, which could have a two-way impact on future oil demand. On one hand, it reinforces expectations of looser supply conditions; on the other, improved economic activity could support demand. Overall, supply and demand forces have yet to align in a clear short-term direction.

Investors are also weighing the possibility of progress in Ukraine negotiations. If the conflict were to end, Russian oil exports could increase significantly, adding further downside pressure to prices. In addition, the upcoming Fed policy meeting—where internal disagreement is likely—has added to overall market caution.

From a technical perspective, WTI has pulled back sharply after failing near the $60 resistance zone, forming a large bearish candle that reflects increasing selling pressure at higher levels. Prices have fallen back below the short-term moving average cluster, signaling weakening near-term momentum. The MACD is showing signs of a bearish crossover near the zero line, indicating fading rebound momentum.

The $59–$60 region near the Bollinger mid-band has become the key battleground for bulls and bears. If daily closes continue below this level, price may retest the $58.00–$58.17 support zone. A break below that could open the way toward the previous low near $57.10. On the upside, the $60 handle remains the most critical resistance. A sustained break above it could open the path toward $62 and beyond.

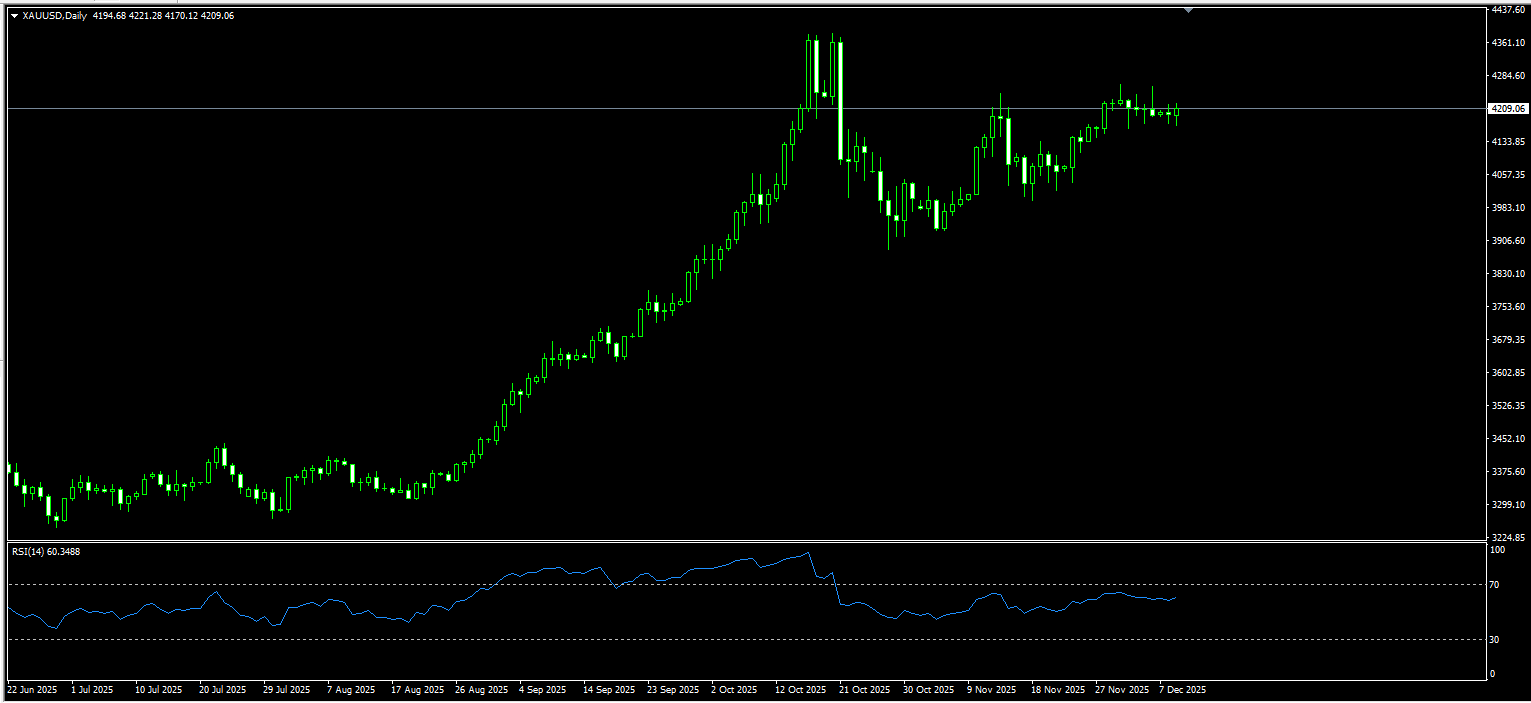

Spot Gold

On Tuesday, spot gold traded near $4,210 per ounce, slipping modestly at the start of the week as investors remained cautious ahead of the Federal Reserve’s policy meeting. Markets are bracing for a “hawkish cut,” awaiting clearer signals on the future rate path.

A hawkish rate cut refers to the Fed lowering interest rates while simultaneously signaling caution toward further easing through its statement language, median projections, and Chair Powell’s press conference. If investors scale back expectations for two to three rate cuts next year as a result, the dollar could gain support, temporarily weighing on gold.

In addition, markets are taking a brief pause ahead of the Fed meeting. Investors are holding their breath for Powell’s latest guidance, while geopolitical tensions, dollar volatility, and unexpected events such as the Japanese earthquake continue to quietly influence gold prices. Overall, while gold faces near-term pressure, its underlying fundamentals remain robust. Continued central-bank buying and safe-haven demand are expected to drive further upside, with some analysts even forecasting a potential move toward $5,000 per ounce by Q1 2026.

From a technical standpoint, key attention is on the $4,175–$4,190 zone, which represents the real-body lows of recent sessions. A decisive break below this area would shift focus back to the short-term trendline and the psychological $4,100 level, which also marks the starting point of the latest rally. A daily close below $4,100 would constitute a clear bearish signal and could lead to a decline toward $4,000.

On the upside, resistance lies in the $4,264.50–$4,271 zone (last week’s high and the upper Bollinger band). This area previously marked the start of the latest down move and has repeatedly rejected upside attempts. Only a strong breakout above this zone would revive bullish momentum toward the record high at $4,381.

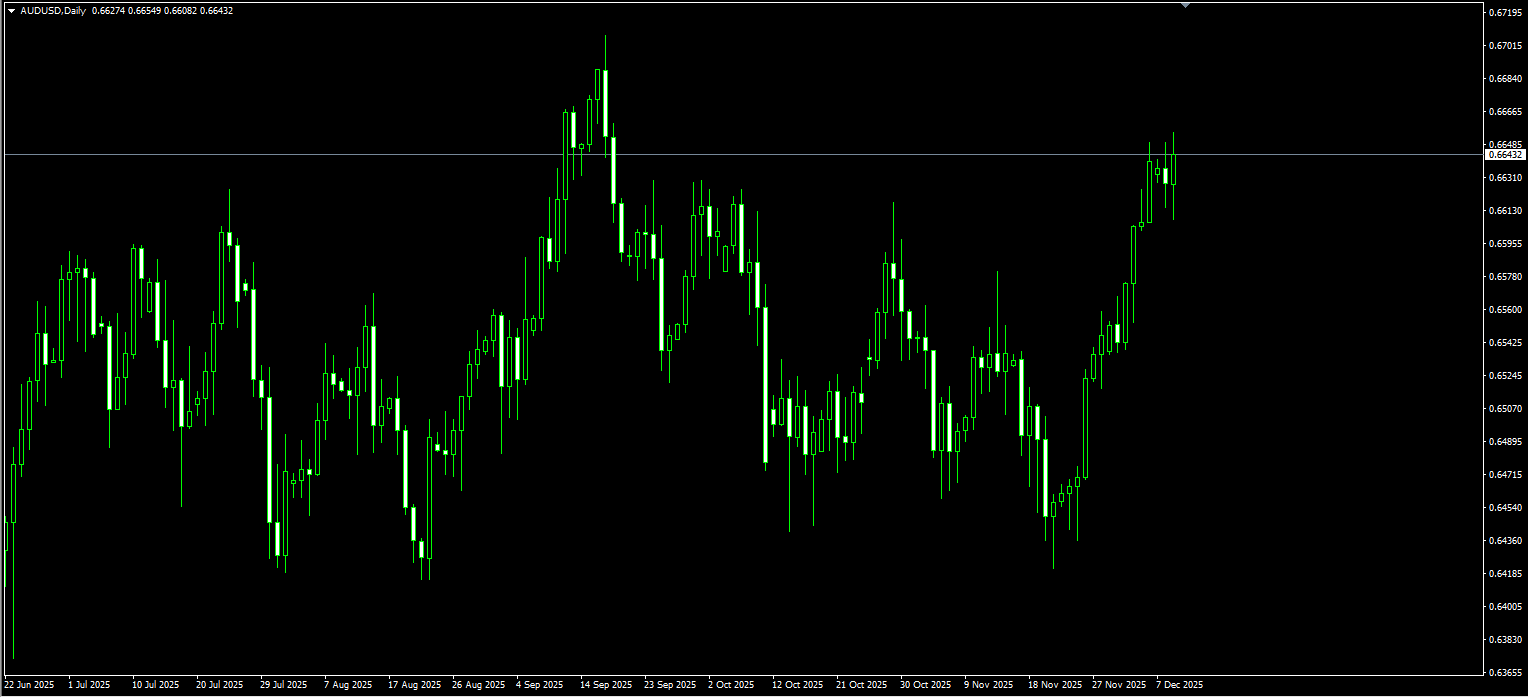

AUD/USD

AUD/USD edged higher during the European session on Tuesday morning, approaching 0.6650, following the Reserve Bank of Australia’s press conference. As expected, the RBA kept its cash rate unchanged at 3.60%. Governor Bullock struck an optimistic tone on economic performance but warned of inflation risks and remained cautious on further policy adjustments.

Since the November policy meeting, inflation has surprised to the upside and economic growth has regained momentum. These developments justified this week’s hold decision and hint that the RBA may be nearing the end of its easing cycle. Details of the report showed that inflationary pressures were broad-based, with accelerating price growth in services. Annual wage growth remains at 3.4% and is expected to hold at that level this year.

Following the release of the monthly CPI, Governor Bullock warned that “if inflation proves more persistent, it would have implications for policy.” According to Refinitiv’s interest-rate probabilities, a series of upbeat data has led money markets to fully price in a rate hike by the end of 2026, whereas only weeks ago markets were still expecting at least one more rate cut early next year.

Technically, AUD/USD remains well supported after breaking above the 0.6600 psychological level, which now serves as immediate support. Holding above this level reinforces the bullish bias. Momentum indicators remain constructive: the MACD is rising in positive territory, while the 14-day RSI is holding around 65, showing strong upside momentum without entering overbought territory.

This keeps the door open for a retest of this year’s high at 0.6707, the strongest level since October 2024. A break above that would expose the next upside target at 0.6800. On the downside, a daily close back below 0.6600 would weaken the short-term bullish outlook, with further downside toward the December 3 low at 0.6553. The buyers’ final line of defense sits near 0.6530, where the 50-day and 100-day SMAs converge.

GBP/USD

GBP/USD hovered near 1.3300 on Tuesday, struggling to find momentum in either direction as the new trading week got underway. Broader market sentiment remains heavily dependent on the upcoming Federal Reserve rate decision, with investors reluctant to take strong bullish or bearish positions ahead of one of the most important policy meetings of the year.

The Fed will conclude its two-day policy meeting on Wednesday, December 10, announcing its decision followed by a press conference. Markets are almost universally expecting a third consecutive rate cut, with rate markets pricing in over a 90% probability of a 25-basis-point reduction to close out the year. Beyond the decision itself, attention will turn to what signals Chair Powell provides regarding the future policy path.

The UK economic data calendar is relatively quiet this week, but sterling traders are preparing for a busy slate of releases next week, which could ultimately pave the way for a Bank of England rate cut.

A breakout above the 1.3275–1.3280 confluence zone—incorporating key retracement levels and long-term technical reference points—has been identified as a key trigger for GBP/USD bulls. With daily oscillators holding in positive territory, any follow-through buying above the 1.3365 area (50% Fibonacci retracement) could push price back toward 1.3400. Further upside momentum could extend toward the 61.8% retracement at 1.3455–1.3460, and eventually toward the 1.3500 psychological mark.

On the downside, corrective pullbacks are likely to find decent support near 1.3300. Any deeper declines may still be viewed as buying opportunities, with downside limited near 1.3225, followed by 1.3200.

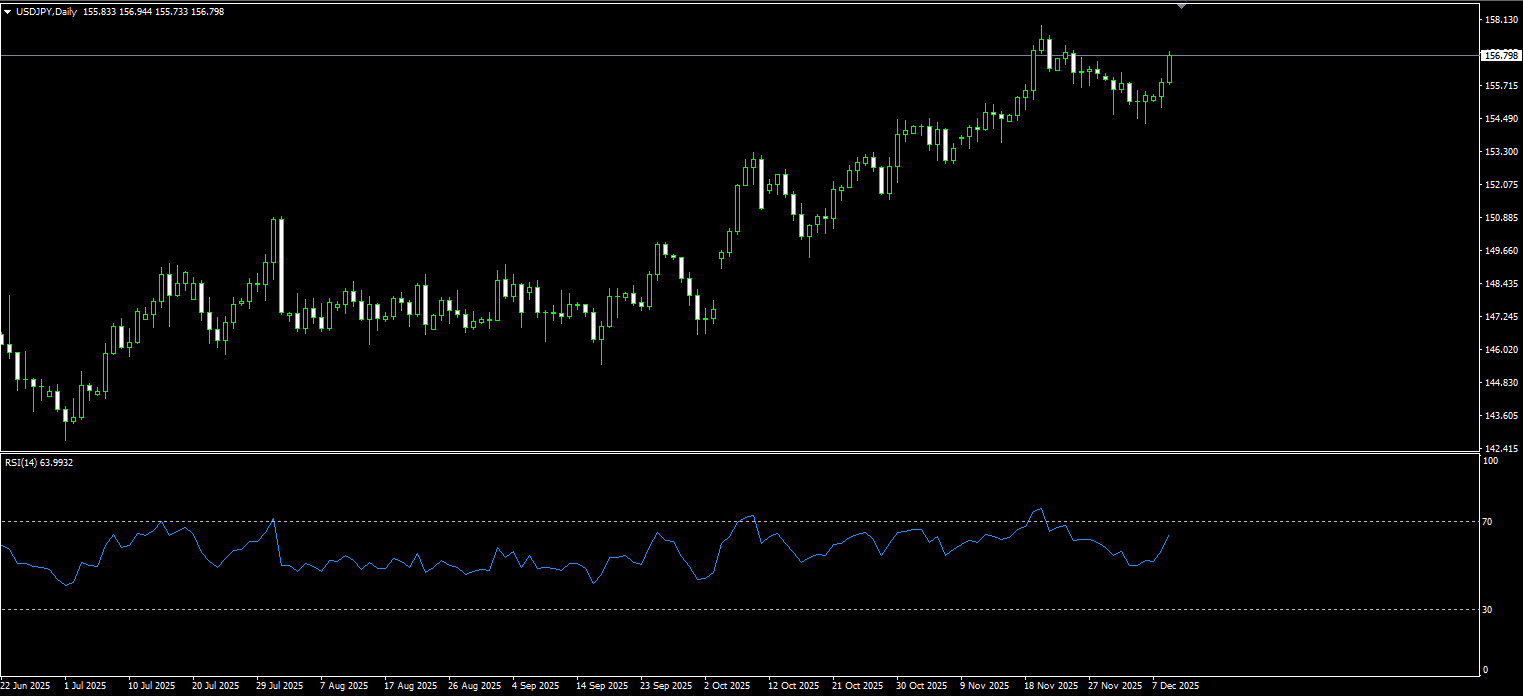

USD/JPY

The Japanese yen stabilized around 156.80 per dollar on Tuesday after initially coming under pressure following a 7.5-magnitude earthquake off Japan’s northeastern coast, which raised concerns about short-term economic disruption. A downward revision to Japan’s Q3 GDP has also weighed on the yen, lending support to broader fiscal spending plans and complicating next week’s Bank of Japan policy decision.

The BOJ is still expected to raise interest rates later this month as part of its policy normalization process. Investors are now awaiting comments from BOJ Governor Kazuo Ueda at a London event later today for further clues on the policy outlook. Meanwhile, traders are positioning for a likely 25-bp Fed rate cut this week, although bets on further U.S. easing in 2026 have diminished.

The U.S. dollar remains near its lowest level since late October, exerting downward pressure on USD/JPY. However, post-earthquake concerns and uncertainty over the Fed’s future guidance prompted a rebound toward the 157.00 region, near a one-week high.

Technically, if USD/JPY continues to rebound, initial resistance is seen near 156.74 (November 27 high). A break above that could open the way toward 157.41 (upper Bollinger band), and ultimately toward the 158.00 psychological level. On the downside, intraday declines may find support near 155.12 (30-period SMA) and the 155.00 psychological mark. A break below that could expose 154.35 (last Friday’s low).

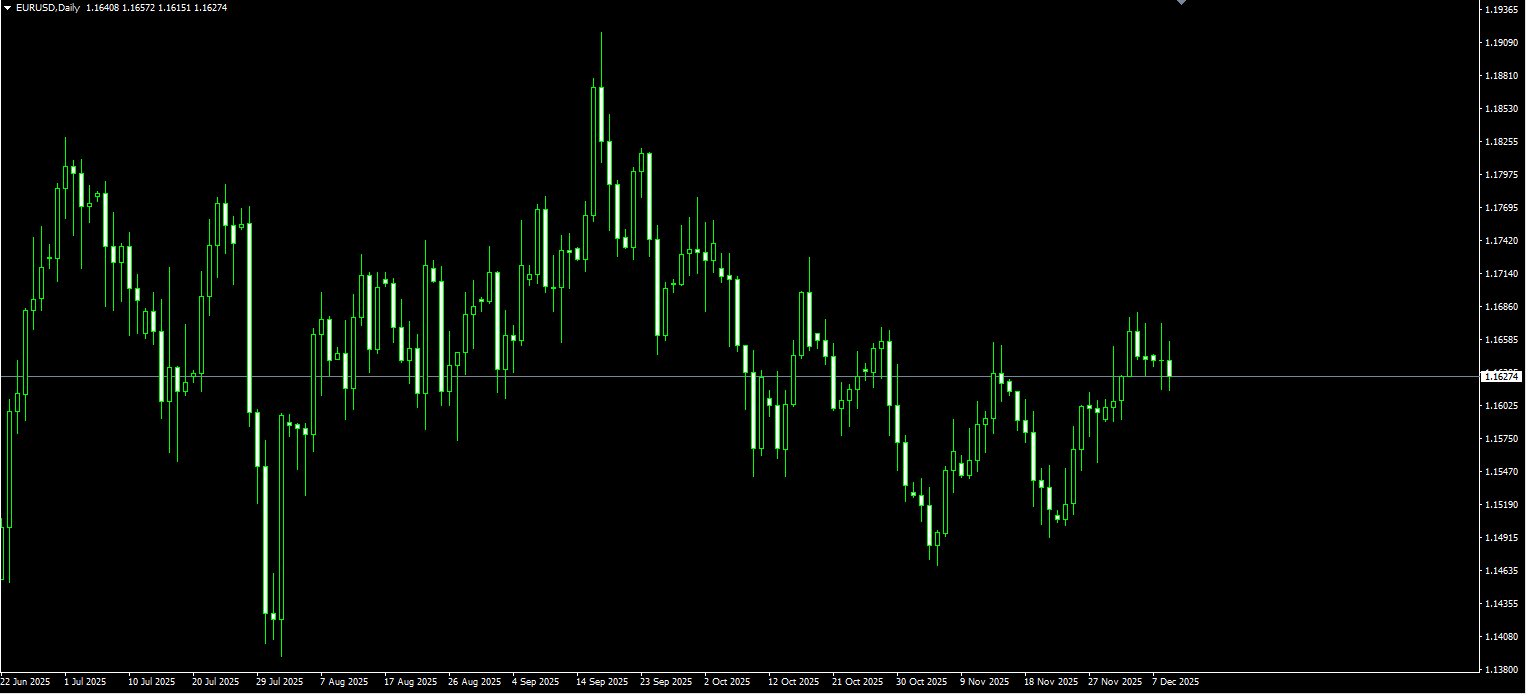

EUR/USD

The euro held steady above 1.1600, near its highest level since mid-October, as traders digested hawkish comments from ECB Executive Board member Isabel Schnabel while awaiting the widely expected Fed rate cut later this week.

Schnabel said she was comfortable with market pricing that sees the ECB’s next move potentially being a rate hike, noting that both growth and inflation risks are tilted to the upside. She also hinted that the ECB’s updated December economic projections could be revised higher. Her remarks, combined with solid economic activity and inflation near target, have reinforced expectations that the ECB may keep rates unchanged through 2026.

Across the Atlantic, U.S. markets currently assign about a 90% probability to a 25-bp Fed rate cut this Wednesday. Investors are also expecting another two to three rate cuts next year, as recent data continue to show cooling in the labor market.

EUR/USD has now held near 1.1640 for a fifth consecutive session, forming a tight consolidation range between that level and 1.1600. Failure to break above 1.1700 has allowed bearish momentum to build, as reflected by the flattening 14-day RSI. A fresh breakout would reopen a test of the 1.1700 psychological barrier, followed by 1.1728 (October 17 high), and potentially 1.1778 (October 1 high).

On the downside, initial support is seen at the 50-day SMA near 1.1605 and the 1.1600 psychological level. A break below this zone would expose 1.1555 (November 28 low), followed by the major psychological support at 1.1500.

*Trading is riskt. General advice only.

Lebih Liputan

Pendedahan Risiko:Instrumen derivatif diniagakan di luar bursa dengan margin, yang bermakna ia membawa tahap risiko yang tinggi dan terdapat kemungkinan anda boleh kehilangan seluruh pelaburan anda. Produk-produk ini tidak sesuai untuk semua pelabur. Pastikan anda memahami sepenuhnya risiko dan pertimbangkan dengan teliti keadaan kewangan dan pengalaman dagangan anda sebelum berdagang. Cari nasihat kewangan bebas jika perlu sebelum membuka akaun dengan BCR.

BCR Co Pty Ltd (No. Syarikat 1975046) ialah syarikat yang diperbadankan di bawah undang-undang British Virgin Islands, dengan pejabat berdaftar di Trident Chambers, Wickham’s Cay 1, Road Town, Tortola, British Virgin Islands, dan dilesenkan serta dikawal selia oleh Suruhanjaya Perkhidmatan Kewangan British Virgin Islands di bawah Lesen No. SIBA/L/19/1122.

Open Bridge Limited (No. Syarikat 16701394) ialah syarikat yang diperbadankan di bawah Akta Syarikat 2006 dan berdaftar di England dan Wales, dengan alamat berdaftar di Kemp House, 160 City Road, London, City Road, London, England, EC1V 2NX. Entiti ini bertindak semata-mata sebagai pemproses pembayaran dan tidak menyediakan sebarang perkhidmatan perdagangan atau pelaburan.